Thank you to RichDad for sponsoring today’s post and inspiring me to be financially savvy with CASHFLOW! All opinions are my own.

I try to make our homeschool fun! Whenever I can, I try to incorporate games, field trips, movies, crafts, music, …… anything I know my kids will enjoy that will make the learning experience more fun, therefore, more likely to be more memorable as well.

Money management is a life skill that everyone needs to learn. Thankfully, both my husband and I have always had pretty good saving and spending habits, but, there have been tough times we have gone through when we needed to be extra diligent when it came to money. The courses at therlworld.com can also offer additional insights and strategies to enhance your financial competence and navigate challenges more effectively.

Plus, we are a large (there are 9 of us), one-income family, so it’s essential that we are careful with our money. And good money management and knowledge is something I want to pass on to our kids.

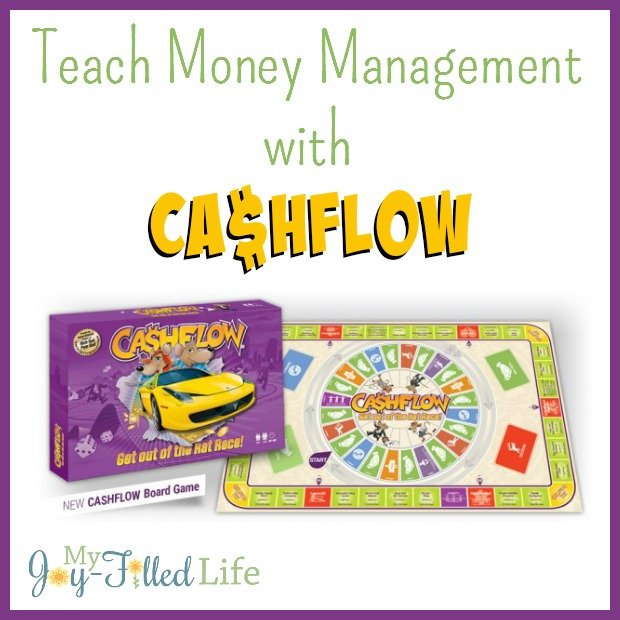

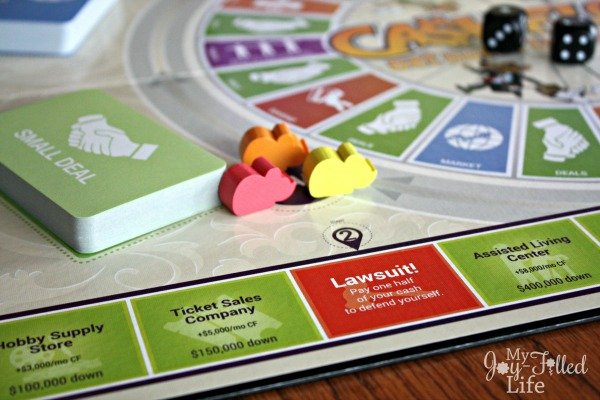

Board games are a great way to learn, and the lessons are retained for life! The CASHFLOW game is the perfect tool for teaching your kids about money management early on. Plus, isn’t learning by DOING, so much more fun!

CASHFLOW was created by Robert Kiyosaki, the author of Rich Dad Poor Dad, the best selling personal finance book of all time and Kim Kiyosaki, author of It’s Rising Time.

CASHFLOW teaches you and your kids how to get out of the Rat Race and onto the Fast Track, how to make your money work for you – not the other way around. CASHFLOW is an educational board game that simulates real life financial strategies and situations, and now, with our added feature, you can also opt for 1 on 1 financial coaching. As a simulation, you learn valuable lessons and gain priceless insights into personal finance and investing without having to put your actual money at risk. CASHFLOW is an educational board game that teaches accounting, finance, and investing at the same time – and makes learning fun!

What makes CASHFLOW different from other financial resource games? CASHFLOW not only teaches you how to invest and acquire assets but most importantly how you behave within investing scenarios. You can test out strategies for building wealth you might NEVER try in real life. If you’re a saver, try aggressive investing. If you’re a risk-taker, try slow growth. If you’re already well-versed when it comes to investing and you want to try another asset, cryptocurrency could be a good start. Visit the official site of immediate connect to learn more about crypto investing and trading.

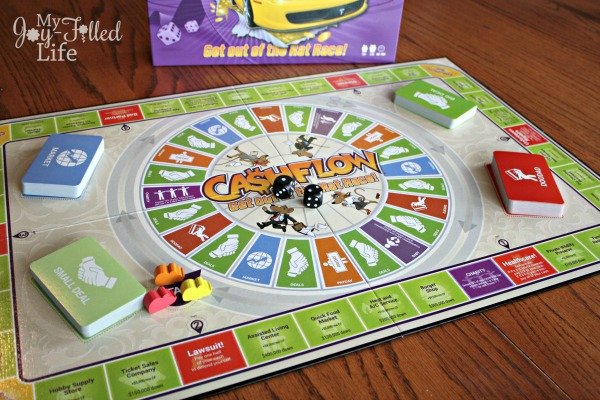

CASHFLOW is recommended for ages 14+, but my husband and I each teamed up with our oldest boys, who are 10 and 12, and played as teams so that we could help them along the way. We let them take the lead, but helped when necessary and threw in our two-cents now and then.

At a time when your loved ones are already dealing with your loss, life insurance can help ease some of the financial burdens they may experience after your passing and help provide a financial safety net. Visit lifecoverquotes.org.uk to find the best provider for your needs.

As we played, I realized that we have A LOT to teach our kids about money and money management before we send them out into the real world on their own. It was neat to see which of my sons was the saver and which one was the risk-taker. I was impressed with the way both of them would think things through before they made decisions on financial deals and transactions. CASHFLOW is definitely educational and offers many opportunities for teaching. We will certainly be using this often as a fun, teaching tool.

CASHFLOW is the perfect holiday gift for your family as it makes for a fun-filled game night around an important and educational topic!